Partnerships for the Goals

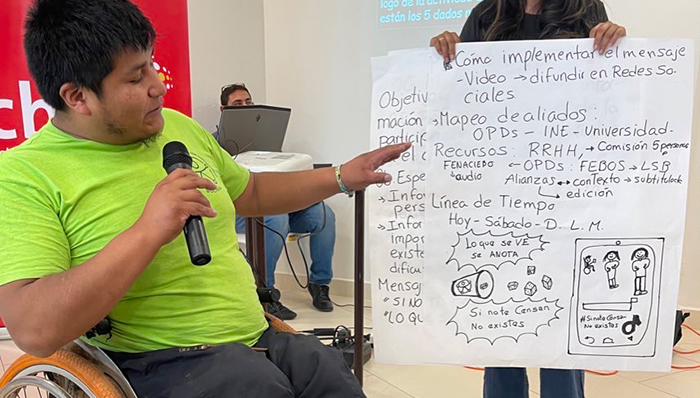

Gary Ramirez presents an action plan to advocate for data on persons with disabilities. It was developed in a workshop for Organizations of Persons with Disabilities in Bolivia.

© CBM Global Disability Inclusion and International Disability Alliancestrengthened global partnerships and enhanced cooperation are urgently needed to address widening financing gaps, reinforce post-pandemic recovery and promote sustainable development, particularly in the LDCs and other vulnerable countries.

The trillions needed to achieve the SDGs require world leaders to rapidly scale up investments

Mobilizing financial resources is crucial for driving global recovery and achieving the SDGs. In 2023, the annual SDG investment gap in developing countries was estimated at about $4 trillion, with over half, or $2.2 trillion, needed for the energy transition alone. The current investment gap is 60 per cent higher than the $2.5 trillion estimated in 2019. The increase results from shortfalls since 2015, compounded by multiple global challenges, including the pandemic and the food, fuel and financing crises.

In 2023, ODA from Development Assistance Committee members totalled $223.7 billion, representing 0.37 per cent of members’ combined gross national income. This marked a 1.8 per cent increase in real terms from 2022 and a 47 per cent rise from 2015, making it the fifth consecutive year of record-high ODA. The increase was primarily driven by aid for Ukraine, humanitarian assistance and contributions to international organizations. Net bilateral ODA flows to Africa increased by 2 per cent and to LDCs by 3 per cent.

Global foreign direct investment (FDI) flows in 2023 amounted to $1.33 trillion, a decrease of 2 per cent from 2022. Excluding a few European conduit economies that registered large swings in investment flows, global FDI flows were 10 per cent lower than in 2022. FDI flows to developing countries fell by 7 per cent to $867 billion and declined or stagnated in most regions.

Remittances have proven resilient. They have become the premier source of external finance for developing countries in the post-COVID-19 period. In 2023, remittances to low- and middle-income countries reached an estimated $669 billion, reflecting a normalization of flows following the post-pandemic robust growth. The United States remained the largest source of remittances in the world, followed by Saudi Arabia and Switzerland. The global average cost of sending a $200 remittance was 6.4 per cent in 2023, more than twice the SDG target of 3 per cent. Development impacts of remittances can be augmented by reducing remittance costs and worker-paid recruitment costs.

In 2022, additional financial resources for developing countries from multiple sources, reported by 101 bilateral and multilateral providers to measure total official support for sustainable development (TOSSD), amounted to $342.1 billion. This included $276.6 billion in official resources, $55.3 billion from private finance and $10.2 billion from private grants for development. Sustainable development grants (both official and private) decreased from $129.2 billion in 2021 to $127.5 billion in 2022. Sustainable concessional development loans increased by 6 per cent from $54.8 billion in 2021 to $58.0 billion in 2022, while non-concessional loans decreased from 106.9 billion in 2021 to $101.3 billion in 2022. Mobilized private finance increased by 21 per cent from 2021.

At the SDG Summit in September 2023, heads of State and government committed to advancing the Secretary-General’s SDG Stimulus proposal of unlocking $500 billion in additional financing and investment annually.

Remittances, foreign direct investment and ODA flows to developing countries, 2015-2023 (billions of dollars)

Rising borrowing costs put developing countries at risk of debt crises

In 2022, the external debt stock of low- and middle-income countries fell for the first time since 2015, dropping to $9.0 trillion from $9.3 trillion in 2021. Even so, external debt stock levels remained unprecedentedly high after more than a decade of rapid debt accumulation. In 2022, the external debt stock of countries eligible to borrow from the International Development Association (IDA) – which supports the poorest countries in boosting economic development – increased by 2.7 per cent, reaching a record high of $1.1 trillion. Public and publicly guaranteed debt service payments by low- and middle-income countries hit a record $444 billion and are forecast to continue growing. Interest payments on total external debt stock by IDA-eligible countries have doubled since 2015 to $23.6 billion and are expected to rise further as global interest rates trend upward. About 60 per cent of low-income countries are at high risk of debt distress or already experiencing it. Increasing borrowing costs have and will continue to divert scarce resources from critical development needs such as poverty reduction, climate action, health and education.

Total debt service and interest payments on external debt for IDA-eligible countries, 2012‒2022 (billions of dollars)

COVID-19 impacted global data collection for the SDGs, highlighting the need for increased investment in statistical systems

High-quality, timely and disaggregated data are crucial for guiding decision-making on all SDGs. The COVID-19 pandemic significantly hindered the ability of national statistical offices to collect recent data. This has led to a small decline in the average Open Data Inventory (ODIN) coverage scores from 2020 to 2022, mainly in low- and middle-income countries. Even in the most resource-rich countries, the average ODIN data coverage score remains below 60 out of 100, highlighting the urgent need for increased investment in data infrastructure and production. Despite these gaps, the long-term trajectory of data coverage score tracks upward.

Based on the Statistical Performance Indicators (SPI), global scores on the Data Sources Performance Index and Data Infrastructure Performance Index improved between 2016 and 2023. Data sources gained only 3 points, held back in part by COVID-19 disruptions, while data infrastructure, both the hard and soft infrastructure to produce data, increased by around 14 points.

In 2023, 159 countries and territories reported having statistical legislation compliant with the Fundamental Principles of Official Statistics, up from 132 in 2019, indicating significant progress in modernizing national statistical systems. Additionally, 163 countries implemented national statistical plans, up from 143 in 2019, with 109 fully funded. showed international support for data and statistics development has increased, reaching $799 million in 2021, 14 per cent above 2020 and 44 per cent above 2015. Funding gaps remain a major issue, particularly in Africa and the LDCs, where only a fraction of plans is fully funded. This resource insufficiency threatens the resilience of statistical systems and risks leaving vulnerable populations behind. Addressing these challenges requires more funding, mainstreamed data activities and strategic planning aligned with emerging development priorities.

Globally, one in three people are still offline, underscoring the urgency of infrastructure investments and affordable Internet access, particularly in underdeveloped regions

Approximately 67 per cent of the world’s population, or 5.4 billion people, was online in 2023, 4.7 per cent more than in 2022 and 69 per cent more than in 2015. Internet use continues to correlate with regional development. Australia and New Zealand and Europe and Northern America have achieved universal usage (above 95 per cent), while only 37 and 38 per cent of people in sub-Saharan Africa and Oceania (excluding Australia and New Zealand), respectively, are online. Although the COVID-19 pandemic temporarily accelerated Internet adoption, recent growth rates have reverted to pre-pandemic levels. Worldwide, 70 per cent of men use the Internet compared to 65 per cent of women, with 244 million more men than women online in 2023. Fixed broadband subscriptions grew at an annual rate of 6.4 per cent between 2015 and 2023, reaching 19 subscriptions per 100 inhabitants globally. These connections are scarce in low-income countries, however, due to high costs and inadequate infrastructure. Investments in infrastructure and affordable Internet access are crucial, especially in underserved regions.

Proportion of individuals using the Internet, 2015 and 2023 (percentage)