It is recommended that the topic of equity components valuation as well as the implications of equity in the sequence of accounts and with respect to the measurement of income be added to the research agenda. Selected issues are discussed below.

Valuation of corporate and other equity sub-components

In the balance sheet account (BSA) SNA holds up the market valuation of corporate equity as the ideal. The TFVME supported this principle, and articulated issues and approaches by which to measure or approximate market values. In doing so, TFVME had cross discussions with the group reviewing the IIP benchmark definition of direct investment in order to ensure as much general consistency as possible. There was general agreement on valuation methods, but not to the point that would necessarily ensure consistent estimates between the BSA and IIP or across countries.

That being said, there are different ways to slice corporate equity, and one of the stumbling blocks of this exercise was that the components of equity were not adequately articulated. This shortcoming is reflected in both SNA93 and SNA93 Rev1. The asset instrument corporate equities has the following dimensions: It can be portfolio investment, inter-company (direct) investment or it can represent participation in an unincorporated business; the first two of these sub-categories can be comprised of marketable securities or non-marketable shares; and, both portfolio and inter-company investment can be domestic or foreign. This issue is further complicated by the fact that the component detail is generally not the same for equity assets and liabilities, with the asset side typically more detailed. These sub-components can have differing valuation and income considerations, and require a more thorough treatment such is afforded other financial instruments (e.g., financial derivatives, deposits, insurance and pension reserves, etc.).

In particular, a discussion of inter-company versus portfolio investment is required, at a minimum, to enhance the valuation of equity practices and to ensure compatibility with the IIP direct investment valuation principles. By more thoroughly considering equity components, there is a reduced risk of inconsistencies on valuation of the equity sub-components and on the treatment of the income arising from the sub-components.

It is proposed that this topic be included on the AEG research agenda.

Residual corporate net worth

Since corporations are owned by their shareholders, it is reasonable to assume that their shareholdings are an estimate of the net worth of corporations. In a situation where all asset-liabilities are valued at market the corresponding net worth value (sometimes referred to as net asset value) should, in principle, equal the net market value share liability. However, in both SNA and in the real world there are good reasons why they do not, giving rise to residual corporate net worth. SNA (including the current re-draft) does not properly confront this reality (describing it more as a possibility), and leaves considerable ambiguity as to the nature of residual corporate net worth. There are two main reasons why residual corporate net worth arises.

First, in SNA all assets and liabilities are not at market value (e.g., loans). This is a statistical reason why the shares at market value would not equal the net asset value for the corporate sector, giving rise to residual corporate net worth. Taking the example of the loans, the market value of the equity of banks would most certainly reflect the impact of a significant change in non-performing loans or significant fluctuations in interest rates, on bank financial positions; however, this would not be reflected in SNA estimates of bank net asset values. Any or missing or mis-valued assets would have a similar impact.

Second, residual corporate net worth can arise for conceptual reasons – specifically, that the market value of corporate shares and the net asset value are different concepts. Only by chance would these measures coincide. One reason for a fluctuating gap between the two measures would be speculative (excess demand) equity market swings. Expansions and corrections in the stock market will determine the value of corporate shares at market value, but may have little to do with the underlying income earning potential of the net assets of corporations. These differences can add to the analytical capacity of the accounts.

Residual corporate net worth seemingly has both a statistical and an analytical aspect to it. It is proposed that this topic be included on the AEG research agenda.

The value of equity and income flows

Book value equity changes are driven by two main factors: Net new issues of shares (in the Financial Account) and undistributed earnings (saving in the Capital Account). Saving is calculated after cash distributions in the form of dividends.

Market value equity changes in the SNA are driven by two main factors: Net new issues in the Financial Account and revaluations of equity positions in the Revaluation Account. The undistributed earnings of corporations are typically factored in to the fluctuations of their shares outstanding at market value, and are therefore implicitly reflected in the Revaluation Account.

There are two basic types of income flows on equity identified in SNA93 – dividends and re-invested earnings. Another component of the return on equity is capital gain; however, these are included in the Revaluation Account.

Dividends

Dividends are a type of property income, typically cash distributions to the shareholders (collective owners) of corporations. These are generally viewed as a distribution of profits, but given their irregularity it has often been argued that dividends do not relate well to sector income arising from current production. In particular, cash dividends can include the distribution o capital gains and exceed earnings in a period. Given these characteristics, it may be advisable to open up a discussion as to the nature of dividends.

Included with dividends in SNA are distributions/withdrawals of income from quasi-corporations. There is an issue in SNA as to where the line might be drawn between a “withdrawal” by a quasi-corporation as income and a “withdrawal” as equity.

Re-invested earnings of direct investment enterprises and parent governments

Corporate saving arises from undistributed earnings, and is used to finance investment. SNA93 currently has an adjustment to undistributed earnings of foreign direct investment companies under the name of re-invested earnings (RIE) – specifically, that income be imputed back to parent enterprises and subsequently be reflected as imputed re-investment in the subsidiary (in the Financial Account), since it is a required source of funds for investment. This concept has been extended to public enterprises and their parent governments in the current re-draft of SNA93.

The rationale for RIE is that it reflects accrual accounting and the ultimate ownership of the earnings. However, arguably RIE is based on book value accounting of parent enterprises only, and sector accounts’ flows are better focussed on economic transactions and not on the ultimate ownership of earnings. Further the application of RIE is uneven across the sectors, applying only to non-resident and government direct investors.

Analytically, it can be argued the application of RIE distorts the sector accounts and the national saving investment link, as well as the balance of payments surplus/deficit. Further RIE are already reflected in the market value of parent enterprises equity positions, such that allocating it in the flows is redundant; and, given that the Financial Account cannot accommodate income, it does not reconcile with the stock-flow framework of the SNA (see the following section).

It is proposed that this topic be included on the AEG research agenda.

Equity in the sequence of accounts

Since the release of SNA93, there has been a serious stock-flow inconsistency in the sequence of accounts related to equity. It arises from the re-invested earnings concept, and it exists because the financial account cannot accommodate income flows (in this case, the change in retained earnings – a book value equity concept). A simple example serves to illustrate this issue.

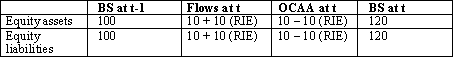

Assume an opening balance sheet of total market value equity of $100 in period t-1, net new equity issues of +$10 in period t and a 10% revaluation of outstanding equity over period t. Closing equity balances are $120.

Stock-flow framework for economy wide totals: Equity

Assume re-invested earnings are +10 in period t. In order to balance the sector accounts of non-residents and national corporations, any adjustments to sector saving for re-invested earnings of +10 must be reflected (the imputed re-investment) in the sector financial accounts. This alters the flow column by a +10. However, since the closing balance sheet is constrained to be $120, an adjustment of -$10 must be made to close the accounts. The only logical account for such an entry is the Other Changes in Asset Account.

Stock-flow framework for economy-wide totals: Equity with re-invested earnings

It was proposed by the TFVME that the Revaluation Account be used to make the required adjustments to offset the RIE effect on the sequence of accounts, as a second-best solution. It is second-best as it seriously compromises the relevance of the revaluation account, with respect to equity at a time when this information has taken on substantially increased analytical importance in most economies. This recommendation has not yet been implemented as yet in the SNA93 Rev1 re-draft.

However, what seems to be required is a re-examination of the treatment of equity stock-flow items, so as to avoid the need for second-best approaches in SNA. A review of stock-flow issues for each of the sub-components of equity (foreign or domestic, marketable or non-marketable, portfolio or direct) is advisable.

It is proposed that this topic be included on the AEG research agenda.

Investment Funds

The broad category of equity in SNA also includes a number of collective investment schemes (both open-end and closed-end) under the broad heading of Investment Funds. It has been agreed to separately identify investment fund units from corporate shares and other equity in the SNA93 re-draft.

However, given the diversity and growth of these funds, and of the incomes and sometimes structural changes accompanying the evolution of these funds, it may be useful to identify and broaden the discussion of the sub-components of these types of schemes (mutual funds, closed end funds, income trusts, etc.) and of their principal investments (equity funds, foreign funds, income funds, etc.). |