15.63. The United States Bureau of Economic Analysis (BEA) compiles data on sales/turnover by industry, with a distinction between sales of goods and sales of services for each industry. To estimate the output of wholesale and retail trade, insurance and finance, the BEA initiated new data collections, developed new compilation methodologies and identified data from other sources.

15.64. To construct estimates of distributive services supplied through affiliates, BEA collects data on the cost of goods sold and the beginning- and end-of-year inventories of the goods for resale on its censuses of FATS, which are conducted every five years.[1] In between its censuses, BEA uses data on the domestic wholesale and retail trade industries to produce estimates of distributive services supplied through affiliates on the basis of movements in trade margins.

15.65. To estimate the value of insurance output supplied through affiliates, BEA deducts “normal” losses—a proxy for insurers’ expectations—from premiums earned. To do so, it uses data collected in its FATS surveys on premiums earned and losses paid by majority-owned affiliates with operations in insurance. BEA uses a six-year moving average of the relationship between premiums earned and losses paid to estimate normal losses. When it first introduced this compilation method, to avoid having to wait until six years of data had been collected on premiums and losses, BEA used data on the relationship between premiums and losses from the domestic insurance industry and gradually replaced them with data collected from affiliates. In addition, information collected on the investment income of majority-owned affiliates with operations in insurance, collected on its FATS surveys, is combined with data on the domestic insurance industry to estimate the value of investment income earned on technical reserves (i.e. premium supplements). This is done by using data on the domestic insurance industry to calculate the share of total investment income that is income on technical reserves and applying that share to affiliates’ investment income to derive an estimate of premium supplements.[2]

15.66. BEA collects and compiles FATS data for banks. It constructs its estimates for financial intermediaries on the basis of data collected on both the banks’ explicit fees and services charges, and on their total interest paid and received, to estimate the value of output by affiliates in banking.

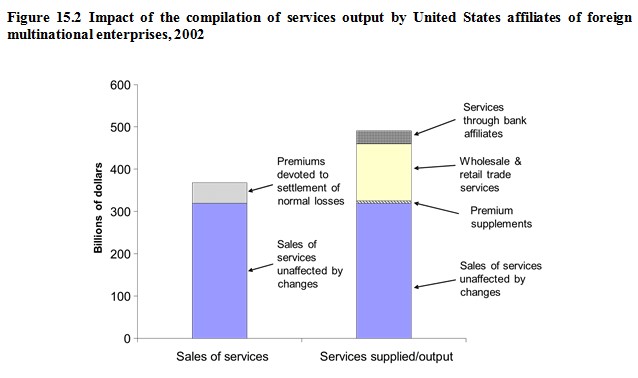

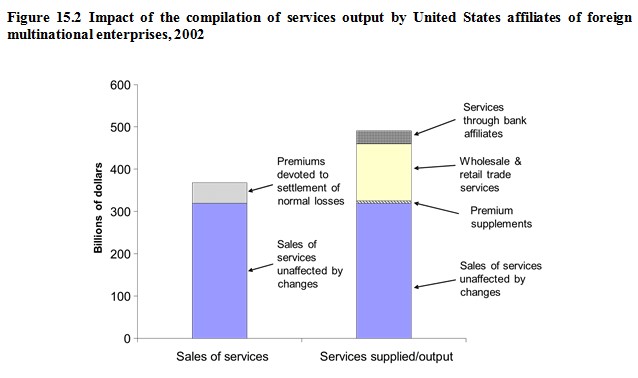

15.67. The impact of the compilation of output/supply of services, as opposed to sales of services by foreign affiliates in the United States (inward FATS), is illustrated in the chart below. Although the impact may differ from one country to another, it is interesting to note that using the more refined variable output to measure the supply of services through mode 3 may substantially change the picture as compared to the use of sales/turnover of services. The example below shows that the preferred measure of output increases by almost one third the estimate for mode 3 supply of services as opposed to data on sales of services.

[1] Originally the data were collected through annual surveys, but now only benchmarks are collected to reduce the burden on reporters and the resources of the United States Department of Commerce, Bureau of Economic Analysis.

[2] The United States Department of Commerce, Bureau of Economic Analysis uses data from a global credit rating agency which focuses on the insurance industry. It breaks out total investment income earned by the domestic insurance industry into categories, including one called “investment gains on funds attributable to insurance transactions”, that is, on their technical reserves. The Bureau takes the percentage that this category accounts for in total investment income and multiplies it by the investment income attributable to insurance for the affiliates to derive their premium supplements. The break-out by destination is used to define the destination of their sales of services.